Printed on December twenty fourth, 2024 by Bob Ciura

It isn’t stunning that we favor shares that pay dividends as research have proven that proudly owning earnings producing securities is a superb technique to construct wealth whereas additionally defending to the draw back.

In bull markets, dividends can add to the positive factors from the inventory whereas additionally buying extra shares. When costs decline, dividends can scale back the losses whereas getting used to amass extra shares at a now lower cost.

With this in thoughts, we created a full record of the Dividend Kings, a bunch of shares with over 50 consecutive years of dividend will increase.

You’ll be able to see the total downloadable spreadsheet of all 54 Dividend Kings (together with essential monetary metrics akin to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

The Dividend Kings record consists of a number of mega-cap shares which have monumental companies, akin to Walmart Inc. (WMT) and Coca-Cola (KO).

These dividend progress shares have been rewarding shareholders with rising earnings for many years. The next 10 shares signify Dividend Kings that may proceed to lift their dividends for many years to return.

The record consists of 10 Dividend Kings with Dividend Danger Scores of A or B within the Certain Evaluation Analysis Database, that even have payout ratios beneath 70% to make sure a sustainable dividend payout.

Desk of Contents

Dividend King To Maintain Eternally: Archer Daniels Midland (ADM)

Archer-Daniels-Midland is the most important publicly traded farmland product firm in the USA. Archer-Daniels-Midland’s companies embrace processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter outcomes for Fiscal Yr (FY) 2024 on November 18th, 2024. The corporate reported adjusted internet earnings of $530 million and adjusted EPS of $1.09, each down from the prior 12 months because of a $461 million non-cash cost associated to its Wilmar fairness funding.

Consolidated money flows year-to-date reached $2.34 billion, reflecting robust operations regardless of market challenges.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADM (preview of web page 1 of three proven beneath):

Dividend King To Maintain Eternally: Becton, Dickinson & Co. (BDX)

Becton, Dickinson & Co. is a worldwide chief within the medical provide trade. The corporate was based in 1897 and has 75,000 staff throughout 190 nations.

The corporate generates about $20 billion in annual income, with roughly 43% of revenues coming from outdoors of the U.S.

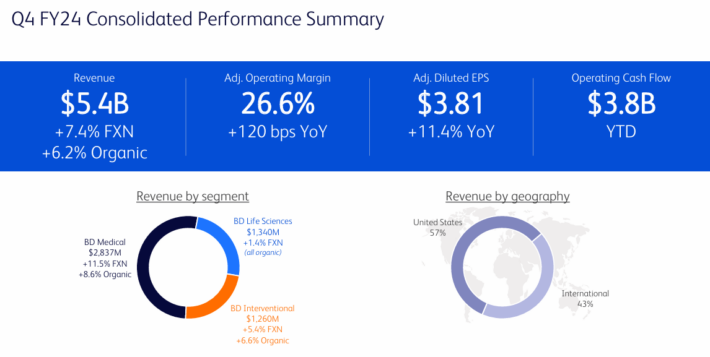

BDX reported outcomes for the fourth quarter and monetary 12 months 2024, which ended September thirtieth, 2024. For the quarter, income grew 6.9% to $5.44 billion, which was $57 million greater than anticipated.

Supply: Investor Presentation

On a foreign money impartial foundation, income improved 7.4%. Adjusted earnings-per-share of $3.81 in contrast favorably to $3.42in the prior 12 months and was $0.04 forward of estimates.

For the fiscal 12 months, income grew 4.2% to $20.2 billion whereas adjusted earnings-per-share of $13.14 in comparison with $12.21 within the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on BDX (preview of web page 1 of three proven beneath):

Dividend King To Maintain Eternally: Kimberly-Clark (KMB)

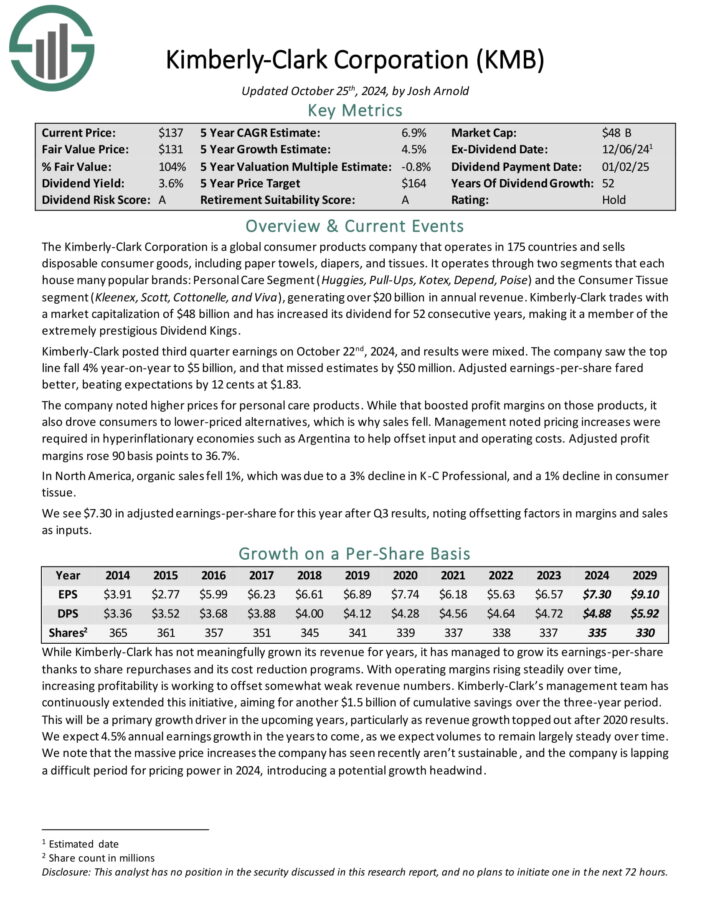

Kimberly-Clark is a worldwide shopper merchandise firm that operates in 175 nations and sells disposable shopper items, together with paper towels, diapers, and tissues.

It operates segments that every home many in style manufacturers: the Private Care Phase (Huggies, Pull-Ups, Kotex, Rely, Poise), the Client Tissue section (Kleenex, Scott, Cottonelle, and Viva), and an expert section. In all, KMB generates ~$21 billion in annual income.

Supply: Investor Presentation

Kimberly-Clark posted third quarter earnings on October twenty second, 2024, and outcomes had been combined. The corporate noticed the highest line fall 4% year-on-year to $5 billion, and that missed estimates by $50 million. Adjusted earnings-per-share fared higher, beating expectations by 12 cents at $1.83.

The corporate famous greater costs for private care merchandise. Whereas that boosted revenue margins on these merchandise, it additionally drove customers to lower-priced options, which is why gross sales fell.

Administration famous pricing will increase had been required in hyper-inflationary economies akin to Argentina to assist offset enter and working prices. Adjusted revenue margins rose 90 foundation factors to 36.7%.

Click on right here to obtain our most up-to-date Certain Evaluation report on Kimberly-Clark (preview of web page 1 of three proven beneath):

Dividend King To Maintain Eternally: Hormel Meals (HRL)

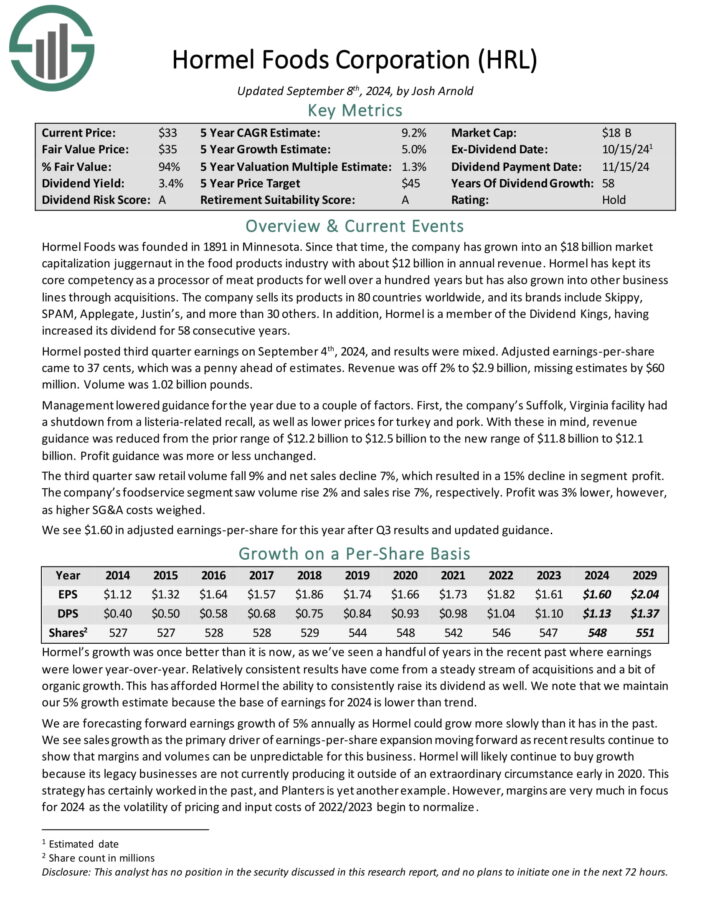

a juggernaut within the meals merchandise trade with almost $10 billion in annual income.

Hormel has stored with its core competency as a processor of meat merchandise for properly over 100 years, however has additionally grown into different enterprise strains by means of acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Just some of its high manufacturers embrace embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

It has additionally pursued acquisitions to drive progress. For instance, in 2021, Hormel acquired the Planters snack nuts enterprise from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s progress.

Supply: Investor Presentation

Hormel Meals Company reported robust Q3 fiscal 2024 outcomes, with internet gross sales of $2.9 billion and adjusted working earnings of $267 million, exceeding expectations.

Key drivers included robust performances in retail manufacturers and worldwide markets, supported by ongoing enhancements from the corporate’s modernization initiatives.

The corporate posted diluted earnings per share of $0.32 ($0.37 adjusted) and a money movement from operations of $218 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on Hormel (preview of web page 1 of three proven beneath):

Dividend King To Maintain Eternally: Johnson & Johnson (JNJ)

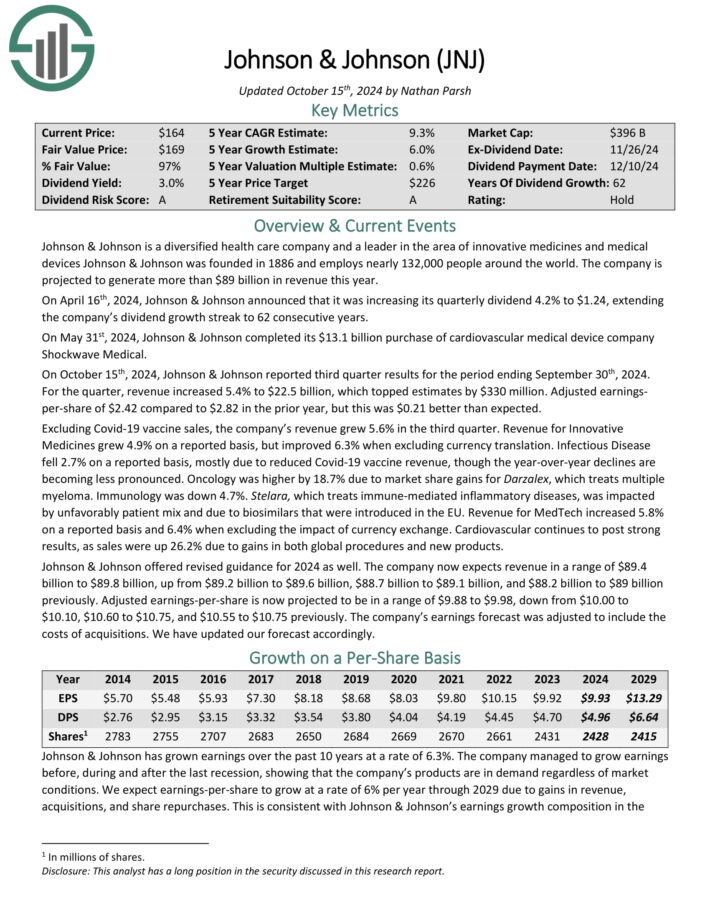

Johnson & Johnson was based in 1886 and has reworked into one of many largest corporations on the planet. Johnson & Johnson is a mega-cap inventory. The corporate generates annual gross sales above $99 billion.

The corporate operates a diversified enterprise mannequin, permitting it to attraction to all kinds of consumers throughout the healthcare sector.

J&J now operates two segments, prescription drugs and medical units, after spinning off its shopper well being franchises.

Johnson & Johnson reported third-quarter 2024 gross sales progress of 5.2%, reaching $22.5 billion, with operational progress of 6.3%.

Supply: Investor Presentation

Nevertheless, earnings per share (EPS) decreased by 34.3%, largely because of a one-time particular cost and purchased in-process analysis and growth (IPR&D).

Adjusted EPS fell 9.0% to $2.42, pushed by the identical IPR&D affect. The corporate made important developments, together with approvals for remedies like TREMFYA and RYBREVANT, and the submission of a brand new normal surgical procedure robotic system, OTTAVA.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven beneath):

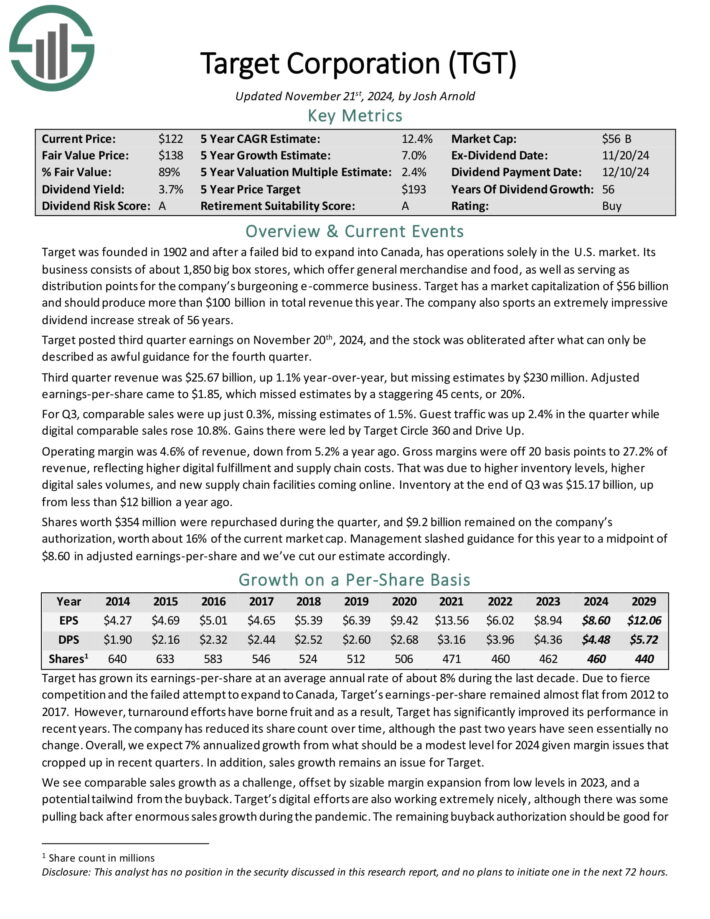

Dividend King To Maintain Eternally: Goal Company (TGT)

Goal was based in 1902 and now operates about 1,850 huge field shops, which provide normal merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted second quarter earnings on August twenty first, 2024, and outcomes had been fairly robust, sending the inventory leaping after the report. Adjusted earnings-per-share got here to $2.57, which was 39 cents forward of estimates. Income was up 2.7% year-over-year to $25.45 billion, which beat by $240 million.

Comparable gross sales had been up 2% year-over-year, making up a lot of the complete gross sales achieve. Consensus was for a achieve of 1.1%. Site visitors was up 3% year-over-year with all six core merchandising classes seeing optimistic progress. Digital comparable gross sales had been up 8.7%, as soon as once more driving progress.

Goal has grown its dividend for greater than 5 a long time, making it a Dividend King. The corporate is investing closely in its enterprise so as to navigate by means of the altering panorama within the retail sector. The payout is now 47% of earnings for this 12 months,

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven beneath):

Dividend King To Maintain Eternally: The Coca-Cola Firm (KO)

Coca-Cola was based in 1892. Right now, it’s the world’s largest non-alcoholic beverage firm. It owns or licenses greater than 500 non-alcoholic drinks, together with each glowing and nonetheless drinks.

Its manufacturers account for about 2 billion servings of drinks worldwide each day, producing greater than $45 billion in annual income.

The glowing beverage portfolio consists of the flagship Coca-Cola model, in addition to different soda manufacturers like Food regimen Coke, Sprite, Fanta, and extra.

The nonetheless beverage portfolio consists of water, juices, and ready-to-drink teas, akin to Dasani, Minute Maid, Vitamin Water, and Sincere Tea.

Supply: Investor Presentation

Coca-Cola dominates glowing gentle drinks, however the firm is making an attempt to take care of and even enhance this dominant place with product extensions of current in style manufacturers, together with diminished and zero-sugar variations of manufacturers like Sprite and Fanta.

Coca-Cola posted third quarter earnings on October twenty third, 2024, and outcomes had been higher than anticipated on each income and earnings. The corporate noticed adjusted earnings-per-share of 77 cents, which was two cents higher than estimates.

Income was off fractionally year-over-year to $11.9 billion, however did beat estimates by $290 million. Natural revenues had been up by 9%. That included 10% progress in worth and blend, a 2% decline in focus gross sales, and a 1% achieve in case volumes.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

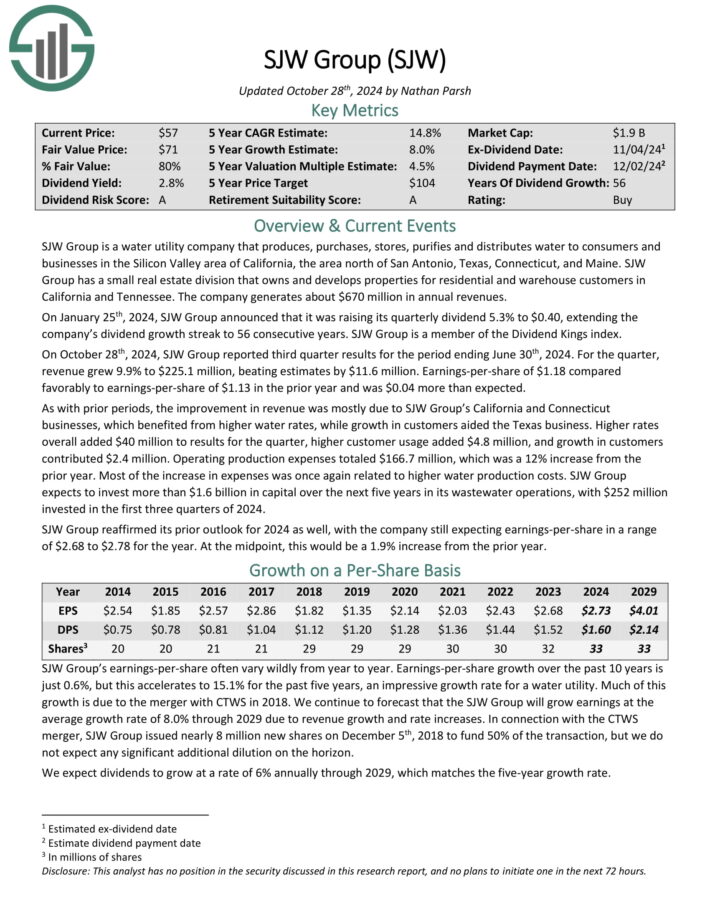

Dividend King To Maintain Eternally: SJW Group (SJW)

SJW Group is a water utility firm that produces, purchases, shops, purifies and distributes water to customers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small actual property division that owns and develops properties for residential and warehouse prospects in California and Tennessee. The corporate generates about $670 million in annual revenues.

Supply: Investor Presentation

On October twenty eighth, 2024, SJW Group reported third quarter outcomes for the interval ending June thirtieth, 2024. For the quarter, income grew 9.9% to $225.1 million, beating estimates by $11.6 million. Earnings-per-share of $1.18 in contrast favorably to earnings-per-share of $1.13 within the prior 12 months and was $0.04 greater than anticipated.

As with prior intervals, the development in income was principally because of SJW Group’s California and Connecticut companies, which benefited from greater water charges, whereas progress in prospects aided the Texas enterprise.

Larger charges general added $40 million to outcomes for the quarter, greater buyer utilization added $4.8 million, and progress in prospects contributed $2.4 million. Working manufacturing bills totaled $166.7 million, which was a 12% improve from the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on SJW (preview of web page 1 of three proven beneath):

Dividend King To Maintain Eternally: Nationwide Gasoline Fuel (NFG)

Nationwide Gasoline Fuel Co. is a diversified vitality firm that operates in 5 enterprise segments: Exploration & Manufacturing, Pipeline & Storage, Gathering, Utility, and Power Advertising. The most important section of the corporate is Exploration & Manufacturing.

Due to its vertically built-in enterprise mannequin, it enjoys important synergies.

Supply: Investor Presentation

In early November, Nationwide Gasoline Fuel reported (11/1/23) monetary outcomes for the fourth quarter of fiscal 2023. The corporate grew its manufacturing 7% over the prior 12 months’s quarter due to the event of core acreage positions in Appalachia. Nevertheless, the common realized worth of pure fuel fell -18%, from $2.84 to $2.33.

Because of this, adjusted earnings-per-share declined -34%, from $1.19 to $0.78, and missed the analysts’ consensus by $0.07. The corporate has crushed the analysts’ estimates in 15 of the final 18 quarters.

Click on right here to obtain our most up-to-date Certain Evaluation report on NFG (preview of web page 1 of three proven beneath):

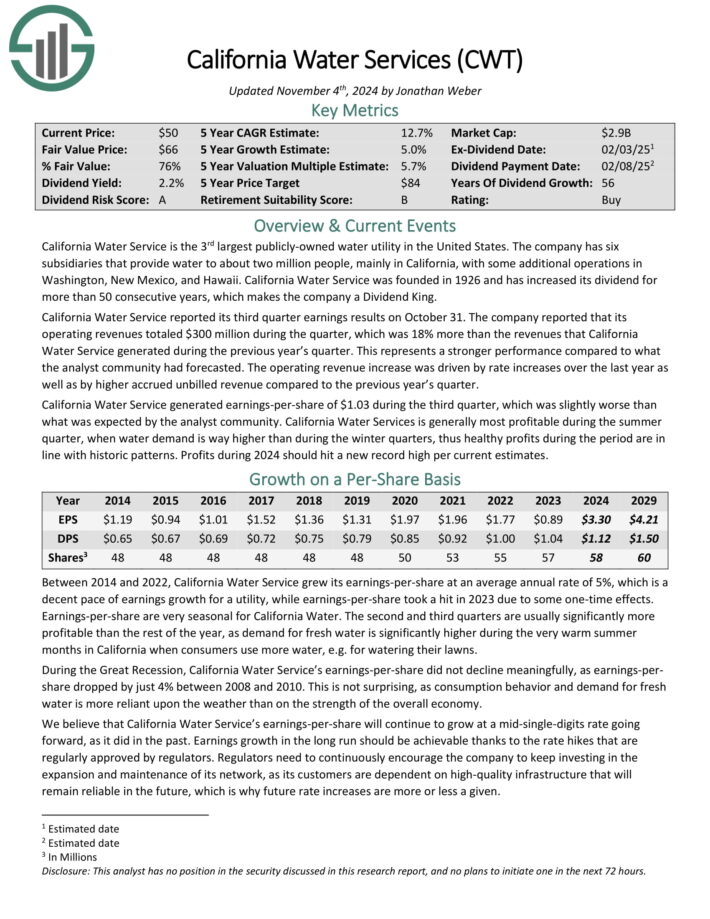

Dividend King To Maintain Eternally: California Water Service Group (CWT)

California Water Service is a water inventory and is the third-largest publicly-owned water utility in the USA.

It was based in 1926 and has six subsidiaries that present water to roughly 2 million folks in 100 communities, primarily in California but in addition in Washington, New Mexico and Hawaii.

Supply: Investor Presentation

California Water Service reported its third quarter earnings outcomes on October thirty first. Working revenues totaled $300 million in the course of the quarter, which was 18% greater than the identical quarter final 12 months. This represents a stronger efficiency in comparison with what the analyst group had forecasted.

The working income improve was pushed by fee will increase over the past 12 months in addition to by greater accrued unbilled income in comparison with the earlier 12 months’s quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on CWT (preview of web page 1 of three proven beneath):

Closing Ideas

Screening to seek out the most effective Dividend Kings is just not the one technique to discover high-quality dividend progress shares to carry endlessly.

Certain Dividend maintains comparable databases on the next helpful universes of shares:

There may be nothing magical about investing within the Dividend Kings. They’re merely a bunch of high-quality companies with shareholder-friendly administration groups which have robust aggressive benefits.

Buying companies with these traits–at honest or higher costs–and holding them endlessly, will seemingly lead to robust long-term funding efficiency.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.