Trders, I stay up for sharing my prime concepts for the upcoming week, together with my exact entry and exit targets, and explaining the precise setups and situations I’m on the lookout for.

So, with out additional ado, let’s soar straight to this week’s watchlist!

Consolidation Breakout in U

The Thought: Prolonged consolidation above a rising 5-day and 50-day SMA. With the lowering quantity and a contracting vary, and its 200-day close to $23 performing as resistance and aligning with the consolidations resistance, it has shaped a bullish consolidation, leading to a possible breakout.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components reminiscent of liquidity, slippage and commissions.

The Plan: If the inventory can break above final week’s excessive, close to its 200-day, together with an uptick in quantity / RVOL, I’ll search for a protracted entry. That entry is likely to be a consolidation above its VWAP intraday after which trying to set a cease both on the LOD or beneath the consolidation breakout. The cease can be trailed on larger lows after that on a 5-minute timeframe. As larger highs are shaped and prolonged from VWAP, I’d scale out of the place, finally concentrating on a number of ATRs.

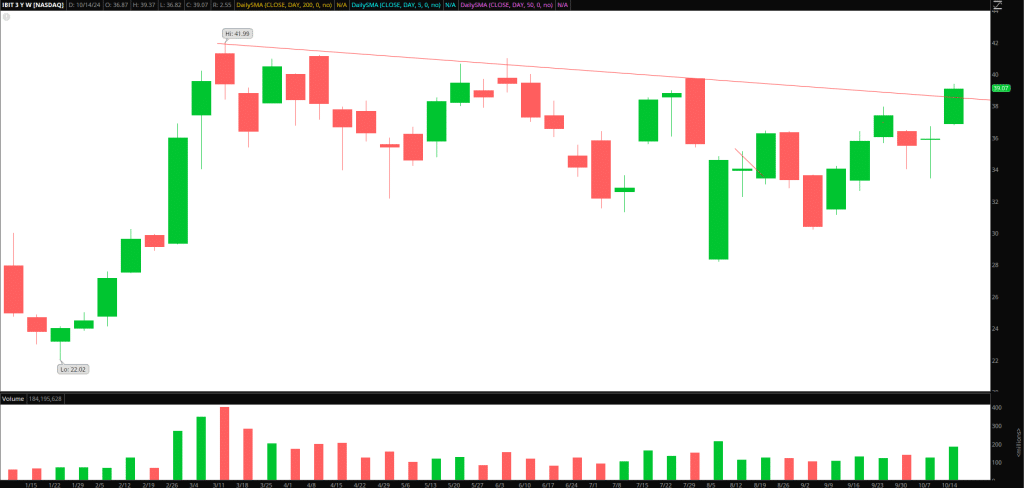

Continuation in Bitcoin (IBIT)

The Thought: Close to file flows just lately into bitcoin ETFs as bitcoin costs in a Trump victory, and it’s undoubtedly risk-on on the whole proper now for the asset class. The best entry was Friday, as laid out yesterday in my Inside Entry assembly. For a recap and clear define of the concept forward of Friday’s transfer, I urge members to return and take heed to that assembly once more.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components reminiscent of liquidity, slippage and commissions.

The Plan: After all, it relies on the motion within the underlying. Within the brief time period, I’d search for larger lows on the day by day chart in IBIT and a contemporary entry if Bitcoin holds agency and IBIT offers a clear larger low or holds above Friday’s excessive. The place could be trimmed on ATR extensions above VWAP. In the end, after a multi-day extension, I’d shut the place and search for a number of days of consolidation for re-entry.

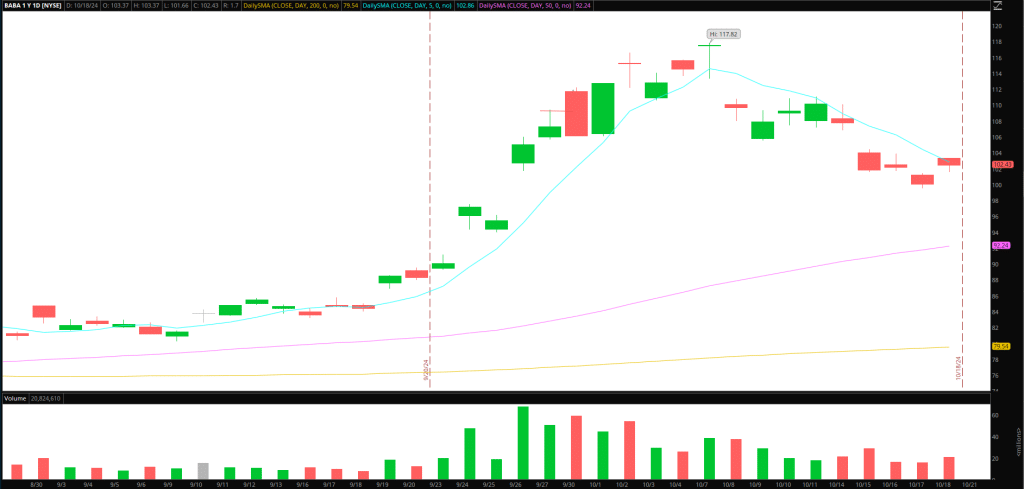

Continuation in China Shares, Particularly BABA

The Thought: After all, the transfer was initially sparked by in depth stimulus and easing introduced by China. Then, final Friday, it’s short-term downtrend broke after optimistic financial information was launched. The transfer follows a measured pullback from the $117.82 highs in BABA, establishing a possible second upmove.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components reminiscent of liquidity, slippage and commissions.

The Plan: If BABA can stabilize above $102 and construct above its declining 5-day SMA, I’d search for an entry lengthy versus the day’s low. This place can be trailed on an hourly timeframe versus larger lows, initially concentrating on a push towards resistance close to $105 – $107. After that, the rest could be trailed versus yesterday’s low.

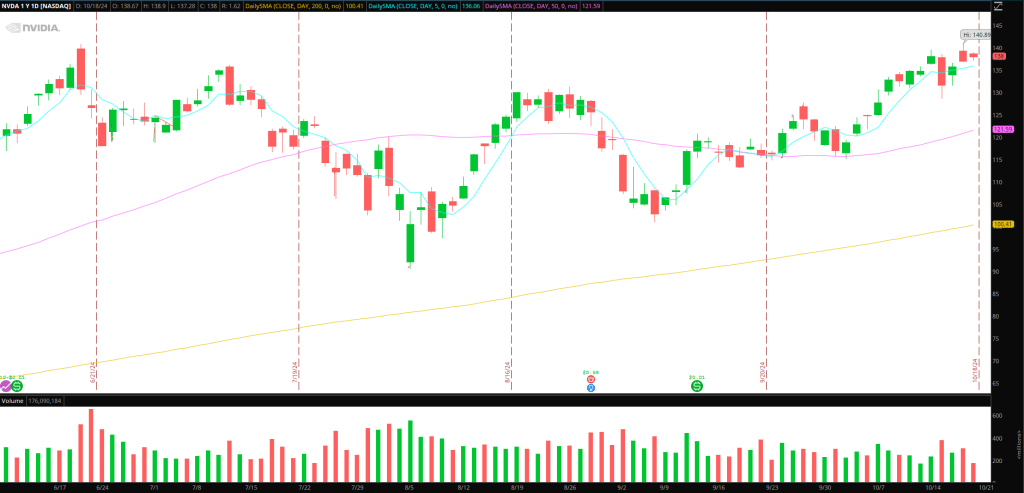

NVDA $140 Breakout

The Plan: After one failed try final week, I wish to see NVDA construct a base on the hourly timeframe of just below $140. This could firmly arrange a momentum breakout above $140 for a multi-day transfer towards $145 – $150. I’ll be watching this carefully within the near-term for the bottom to align on a number of timeframes, establishing a possible ATH breakout.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market components reminiscent of liquidity, slippage and commissions.

Extra Names on Watch:

VTAK: On look ahead to a possible brief if the inventory can push again towards its 2-day VWAP and fail.

NUZE: If $2 continues to fail, I’d be open to a brief versus the day’s excessive, concentrating on a transfer again towards $1. Nevertheless, like VTAK, if it bases above resistance, arms off as a liquidity lure and brief squeeze might play out.

ROKU: Stays on watch, much like final week’s plan. Importantly, I must see this agency up above $80 earlier than getting into lengthy for a multi-day breakout.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures