The max threat in a calendar choices unfold is the debit paid for that calendar, supplied that the commerce is exited at or earlier than the expiration of the near-term possibility.

That is probably not utterly apparent in the event you hear it for the primary time.

On this article, we are going to show that is the case.

Contents

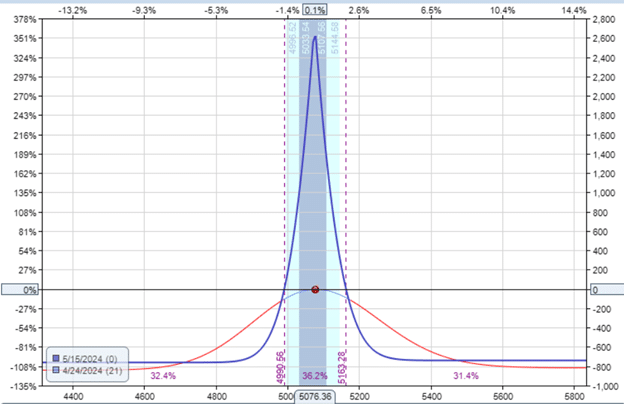

As modeled by OptionNet Explorer utilizing historic pricing, the next is an at-the-money put-calendar on SPX bought on April 24, 2024…

Date: April 24, 2024

Value: SPX @ 5076

Promote one Could 15 SPX 5075 put @ $60.75Buy one Could 22 SPX 5075 put @ $68.15

Internet debit: -$740

Delta: 0.09Theta: 24.50Vega: 75.06

The near-term quick put possibility expires in three weeks.

And the far-term lengthy put expires one week after that.

We’re involved with the worst-case state of affairs on the expiration of the near-term possibility – on this case, on Could 15.

Suppose that SPX rallied up and the value of SPX was above the calendar at, say, 5400 on Could 15.

In that case, the quick put would have expired nugatory, and the lengthy put would nonetheless have some worth left within the possibility.

The purpose is that the dealer would haven’t any obligation to satisfy at expiration.

The quick put possibility is an obligation to purchase on the strike worth if the underlying worth is beneath the strike worth.

On this case, the value is above the strike worth, so there isn’t any obligation.

No cash modifications arms.

The dealer is simply out of the debit that was paid for the calendar.

The truth is, the dealer may recoup a few of that debit by promoting the lengthy put for no matter worth is left there.

Even when the dealer decides to not promote the lengthy put possibility, and if, within the worst-case state of affairs, the lengthy put possibility turns into nugatory, the dealer isn’t any worse off than dropping the cash she or he paid initially for the calendar.

What if the SPX worth had dropped means beneath the calendar – say at 4800 on Could 15?

In that case, the dealer does have an obligation as a result of quick put possibility.

The dealer should “purchase” the SPX index at 5075.

The phrase “purchase” is in quotes as a result of one cannot purchase the SPX index.

It’s cash-settled.

If the market worth is 4800 and the dealer buys at 5075, the dealer is out $27500 as calculated by (5075 – 4800) x 100.

If the dealer had solely the quick put possibility, that will be the quantity the dealer misplaced.

Fortuitously, the dealer has a long-put possibility with a strike of 5075.

This lengthy put entitles the dealer to promote at 5075.

The dealer makes use of the lengthy put to “promote at 5075” to satisfy the duty to “purchase at 5075”. It’s internet zero.

Each quick and lengthy put choices are gone on the expiration of the near-term possibility.

All that the dealer loses is the debit initially paid for the calendar.

Now we perceive the significance of the lengthy put possibility and bear in mind by no means to promote the lengthy possibility of a calendar with out first eradicating the duty of the quick possibility.

What’s extra typical is {that a} dealer will shut the 2 choices concurrently in the identical transaction to exit the calendar commerce.

Obtain the Choices Buying and selling 101 eBook

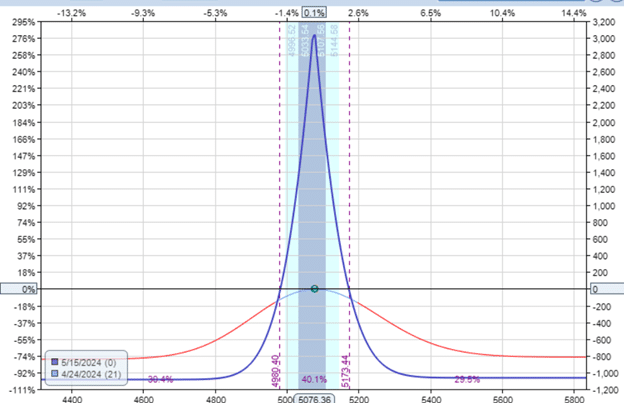

A name calendar on April 24 would have value $1085 and would seem like this:

Delta: 0.1Theta: 24.5Vega: 75

It had the identical expirations and strikes because the put-calendar.

It value a bit extra at $1085 versus $740 as a result of put-call skew within the SPX.

Let’s carry out the thought experiment to see that the worst-case state of affairs is the place the utmost loss is the price of the calendar.

If SPX is above the decision calendar on Could 15, then the quick name possibility is in-the-money.

The dealer is obligated to “promote” at 5075.

The dealer makes use of the proper of the lengthy name choice to “purchase” at 5075 to carry out the duty to promote at 5075.

Each choices are gone, and the dealer loses the cash initially paid for the calendar.

If the value of SPX is beneath the calendar, the quick name possibility expires nugatory.

The dealer is left with a protracted name that can be utilized nevertheless she or he needs.

Within the worst case, the lengthy name turns into nugatory, and the dealer solely the price of the calendar.

An extended possibility doesn’t have an obligation hooked up to it.

Solely quick choices have obligations.

By seeing in all eventualities what obligations need to be fulfilled on the expiration of the near-term possibility, we decided that every one obligations may be fulfilled with out incurring any additional value aside from the preliminary value of the calendar.

That is supplied that the dealer maintains the lengthy possibility for your entire period whereas holding the quick possibility.

The utmost potential reward of the calendar (the height of the expiration graph) is simply an estimate and may change because the commerce progresses as a result of volatility altering between the 2 choices.

Nonetheless, the price of the calendar is the utmost attainable threat of the commerce on the expiration of the near-term possibility, assuming each choices are closed on the expiration of the near-term possibility.

This quantity is mounted and doesn’t change.

We hope you loved this text on What’s the most threat of a calendar choices unfold.

If in case you have any questions, please ship an e-mail or depart a remark beneath.

Commerce secure!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who aren’t aware of alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.