Up to date on November fifteenth, 2024

This can be a visitor contribution by Kanwal Sarai from Merely Investing, up to date by Bob Ciura

Buyers can comply with a number of totally different methods for shares. Some buyers comply with momentum methods, buying and selling shares with excessive worth positive factors. Different buyers comply with a excessive development technique specializing in tech shares, like Apple (AAPL) and Amazon (AMZN).

One more sort of investor seeks revenue by shopping for and holding high-yield shares, like utilities and actual property funding trusts (REITs).

A fourth strategy is dividend development investing, specializing in shares that pay a rising dividend yearly. This technique is more and more standard, and the kind of shares are categorized into the Dividend Achievers, Contenders, Aristocrats, Champions, and Kings.

The Dividend Aristocrats are a gaggle of 66 shares within the S&P 500 Index, which have elevated their dividends for 25+ consecutive years.

You possibly can obtain an Excel spreadsheet of all 66 Dividend Aristocrats (with metrics that matter reminiscent of dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

This text will talk about dividend development investing, and a number of other of the varied lists of dividend development shares.

What’s Dividend Development Investing?

Dividend development investing is an strategy to purchasing and holding the inventory of corporations growing their dividend yearly.

Dividend development buyers want to spend money on undervalued shares paying a dividend as a substitute of overvalued shares that don’t.

As well as, these buyers rationalize that dividends require actual money to pay shareholders and thus are an indicator of the businesses’ precise earnings and well being.

Moreover, an organization demonstrating the flexibility to boost the dividend yearly over time in all probability has a superb enterprise mannequin.

However, an organization reducing or suspending its dividend is clearly struggling.

Dividend development shares are sorted into teams known as the Dividend Achievers, Contenders, Aristocrats, Champions, and Kings, however what precisely are they?

What are the Dividend Achievers, Contenders, Aristocrats, Champions, and Kings?

Dividend Achievers are corporations which have raised their dividends for ten years in a row or extra. In addition to the 10-year dividend development streak, corporations should be listed on the New York Inventory Trade or Nasdaq and have a three-month common every day buying and selling quantity of $1 million.

At present, there are about 400 Dividend Achievers. Many corporations are from the Shopper, Industrials, Financials, and Utilities sectors. As well as, the group consists of corporations like Microsoft (MSFT), and many others.

The subsequent class is the Dividend Contenders. They’re shares elevating the dividend for between 10 and 24 years. The checklist is just like the Dividend Achievers checklist, however since it’s capped at 24 years, the full variety of corporations is smaller.

At present, there are round 368 Dividend Contenders. The sector with probably the most important illustration is Monetary Providers, adopted by Industrials and Utilities. This group consists of corporations like House Depot (HD), Huntington Ingalls Industries (HII), and lots of native and regional banks.

The Dividend Aristocrats are corporations which have raised their dividends for 25+ years and are part of the S&P 500 Index.

As well as, they will need to have a minimal market capitalization of $3 billion and a $5+ million common every day buying and selling quantity for the three months earlier than the rebalancing date.

There are at the moment 66 Dividend Aristocrats. The quantity is comparatively small due to the stricter necessities. Sectors with probably the most important illustration are Shopper Staples and Industrials.

Firms on this checklist are sometimes bigger, well-established corporations which might be market leaders. For instance, corporations like Worldwide Enterprise Machines (IBM), Colgate-Palmolive (CL), Coca-Cola (KO), and Consolidated Edison (ED) are on the checklist.

The Dividend Champions are just like the Dividend Aristocrats. Nevertheless, the one requirement is growing the dividend for 25 or extra years. Consequently, the variety of corporations on the checklist is bigger at 137.

As well as, the checklist consists of corporations which might be part of the Dividend Aristocrats and ones with a market capitalization of lower than $3 billion and will not be a member of the S&P 500 Index.

The 2 sectors with probably the most illustration are Industrials and Monetary Providers. Smaller corporations on this checklist embody MGEE Power (MGEE), and Sonoco Merchandise (SON).

The final class is the Dividend Kings. To achieve this standing, an organization should enhance the dividend for 50+ consecutive years. There is no such thing as a different requirement; nonetheless, the duty just isn’t a simple one.

At present, there are solely 53 corporations on the checklist. Examples of corporations on this checklist embody Federal Realty Belief (FRT), Emerson Electrical (EMR), Johnson & Johnson (JNJ), and Procter & Gamble (PG).

Dividend Aristocrat Spotlight: Pentair plc (PNR)

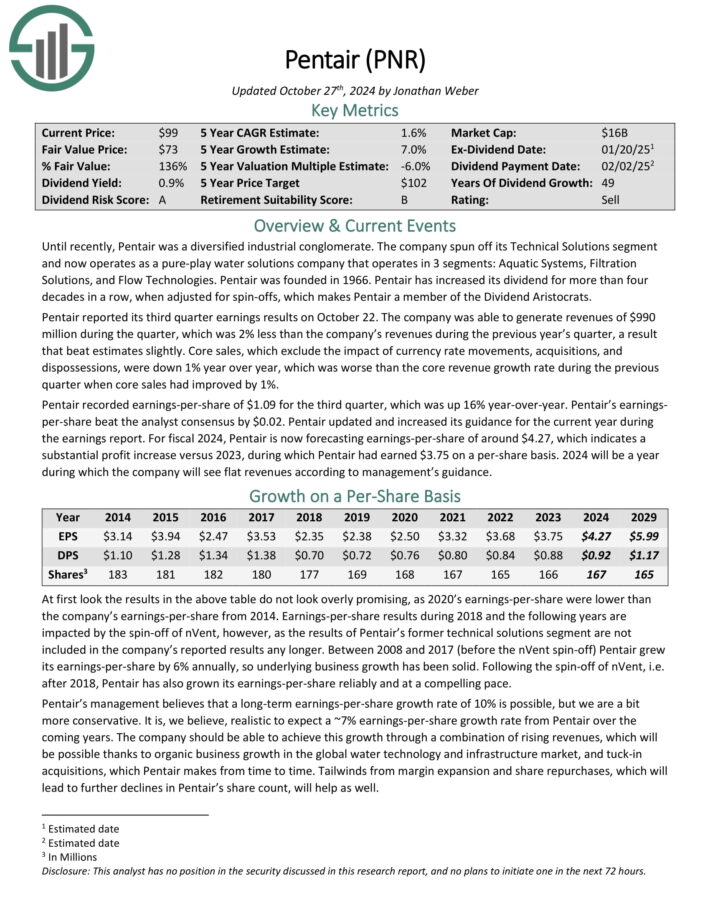

Pentair is a water options firm that operates in 3 segments: Aquatic Programs, Filtration Options, and Circulate Applied sciences. Pentair was based in 1966.

Pentair has elevated its dividend for greater than 4 a long time in a row, when adjusted for spin-offs. Pentair is without doubt one of the high water shares.

Pentair reported its third quarter earnings outcomes on October 22. The corporate was capable of generate revenues of $990 million throughout the quarter, which was 2% lower than the corporate’s revenues throughout the earlier yr’s quarter, a outcome that beat estimates barely.

Core gross sales, which exclude the affect of foreign money price actions, acquisitions, and dispossessions, have been down 1% yr over yr, which was worse than the core income development price throughout the earlier quarter when core gross sales had improved by 1%.

Pentair recorded earnings-per-share of $1.09 for the third quarter, which was up 16% year-over-year. Pentair’s earnings-per-share beat the analyst consensus by $0.02.

Click on right here to obtain our most up-to-date Certain Evaluation report on Pentair (preview of web page 1 of three proven beneath):

Dividend King Spotlight: Dover Company (DOV)

Dover Company is a diversified international industrial producer with annual revenues of practically $9 billion. Dover consists of 5 reporting segments: Engineered Programs, Clear Power & Fueling, Pumps & Course of Options, Imaging & Identification, and Local weather & Sustainability Applied sciences.

Barely greater than half of revenues come from the U.S., with the rest coming from worldwide markets.

Supply: Investor Presentation

Dover Company reported its monetary outcomes for Q3 2024, highlighting regular income development regardless of financial challenges.

Income rose by 1% to $2.0 billion in comparison with the identical interval in 2023, whereas GAAP earnings from persevering with operations elevated by 19% to $313 million, with diluted earnings per share (EPS) from persevering with operations up 22% to $2.26.

Click on right here to obtain our most up-to-date Certain Evaluation report on DOV (preview of web page 1 of three proven beneath):

Which shares ought to I spend money on?

On the finish of the day crucial query for buyers is: Which shares ought to I spend money on? The straightforward reply is: Put money into high quality dividend paying shares when they’re priced low (undervalued).

The Merely Investing on-line course teaches you precisely the right way to determine when a inventory is a top quality inventory (and when it isn’t a top quality inventory), and when a inventory is undervalued (and overvalued).

A easy guidelines of 12 guidelines of investing lets you choose high quality shares when they’re undervalued, and simply filter by the checklist of dividend Achievers, Contenders, Aristocrats, Champions, and Kings.

Different Dividend Lists

The next lists comprise many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.